Skip the Latte—Buy a Home: How Small Lifestyle Tweaks Unlock Big Equity in Texas

Skip the Latte—Buy a Home: How Small Shifts Make Wealth Builders

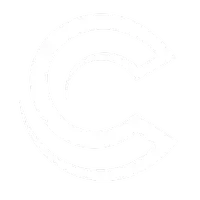

Owning a home—and building lasting wealth through equity—is the American Dream. Yet many tell themselves they “can’t afford” to buy, while unwittingly funding a landlord. Let’s shift that mindset, curb small expenses, and pave your path to equity ownership.

The Equity Equation vs. Rent Reality

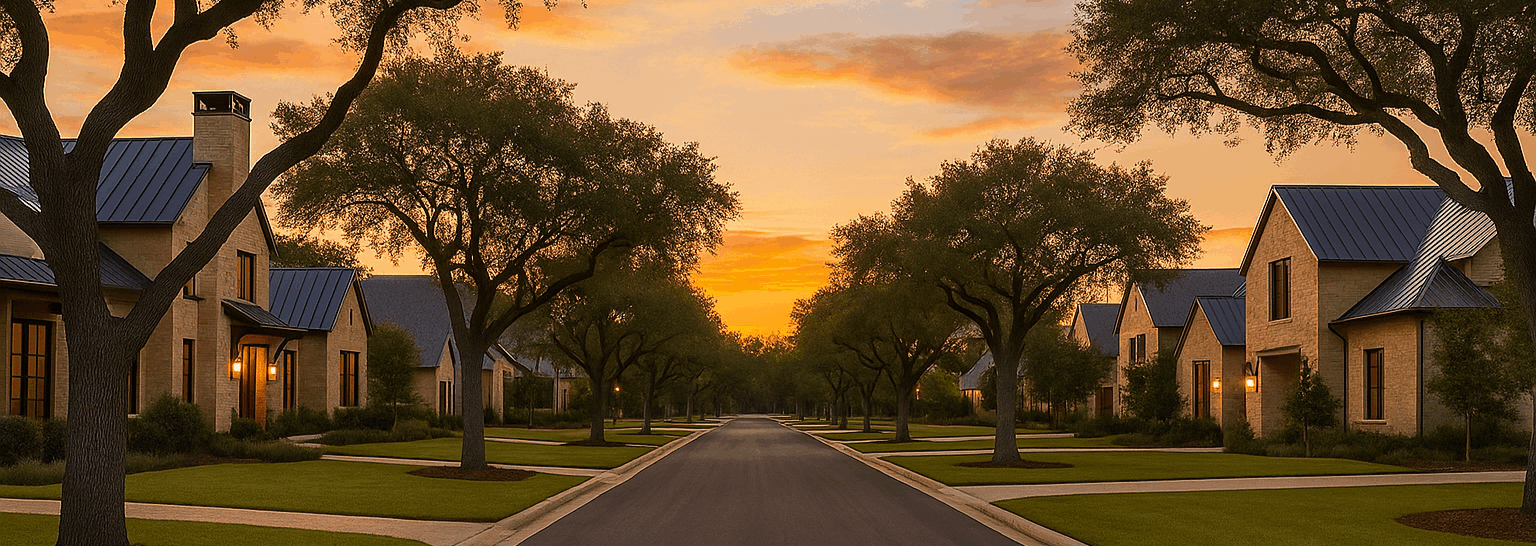

Greater Houston renters often pay around $1,900/month—that’s over $22,800/year benefiting landlords, not the homeowner. Meanwhile, a mortgage on a $340K home builds your stake, not theirs.

You’re Spending More Than You Think

- $300–$500/month on dining, delivery, and coffee habit

- Redirect just $350/month—equals $4,200/year toward homeownership

Many renters spend $300–$500 monthly on food delivery, dining out, coffee runs—think Uber Eats or Starbucks. While local grocery costs are relatively low—roughly $381/month for a single adult—those little indulgences add up fast.

Just $350/month redirected toward a mortgage instead could equal $4,200/year—enough to powerfully boost your homebuying readiness.

Your Step-by-Step Shift

- Review your monthly statements for small but frequent expenses

- Replace daily perks with equity-building routines

- Reframe: every saved dollar is tomorrow’s equity

- Start with a starter home, then grow with confidence

Why This Works in Houston’s Market

Houston’s average rent (~$1,200–$1,600/month) is catching up to costlier ownership, but home equity gains still outpace rental inflation in long-term wealth growth.

Wealth Building Starts Small—and Real

In five years, you’ll reflect on two paths:

- Still renting, expenses rising with no returns

- Equity-growing, asset-building homeownership

A Letter from Daniel

“Homeownership isn’t just financial—it’s emotional, strategic, and life-shaping. We craft plans that shift your spending into saving—and your rental costs into equity. The choice today defines your tomorrow. Let’s start stacking your equity, not someone else’s.”

— Daniel Plant, CMPS

Categories

- All Blogs (23)

- Buyer Intelligence (2)

- Buyer Resources (5)

- Community Update (2)

- Company Anointments (1)

- Company Services (3)

- Corporate Services (2)

- Educational & Advisory Tags (13)

- Guest Contributors (1)

- home lending mortgage (2)

- Homes lending services (1)

- Houston News (1)

- Houston Trends (1)

- Listing Announcement (1)

- Market Review (8)

- Notable News (3)

- Seller Insights (7)

- Seller Resources (9)

- Selling Strategy (8)

Recent Posts

Your Strategy Begins with the Right Information

Real estate moves are serious — whether you're selling your legacy home, buying your next chapter, or investing in long-term wealth. Every article here is written to elevate your confidence and guide smarter decisions.